Part 1: What to do when your property is suddenly in a flood zone

Hello World!

This is Joan, no I have not abandoned my website :) The reason that I’ve not been blogging about real estate is because I’ve been busy doing real estate. Gotta stay ahead of the curve and win those bidding wars!!!!

But today (night, actually), I’ve got a little time and I wanted to share some knowledge that I had just last month gained about properties in flood zones.

The entire process of gaining this knowledge was seriously unpleasant. In fact, just thinking about it now is giving me a headache. I had headaches, I had stomachaches, I had sleepless nights… I paid for this knowledge with my good health, alright.

So here goes this post about what to do when your property is suddenly in a flood zone.

The keyword, is suddenly.

Suddenly was what brought above said trauma, that you, dear reader, would hopefully not find yourself in the same situation. Ever. Or if you do, read carefully as to what I did so that you would live longer days.

You’re welcome.

1. Maybe first check if the property is in a flood zone?

I know, I said that this post would talk about sudden occurrences of flood classification, but one could ALWAYS check prior to viewing a property if the property is in – or near – a flood zone.

See, if you knew about it beforehand, it wouldn’t be sudden.

I can guarantee you that many agents do not check this before showings. When the days get busy and showing requests turn up unexpectedly, you can bet many of us rely on what’s stated in the listing sheet without doing extra legwork before showings.

The way to check this is simple.

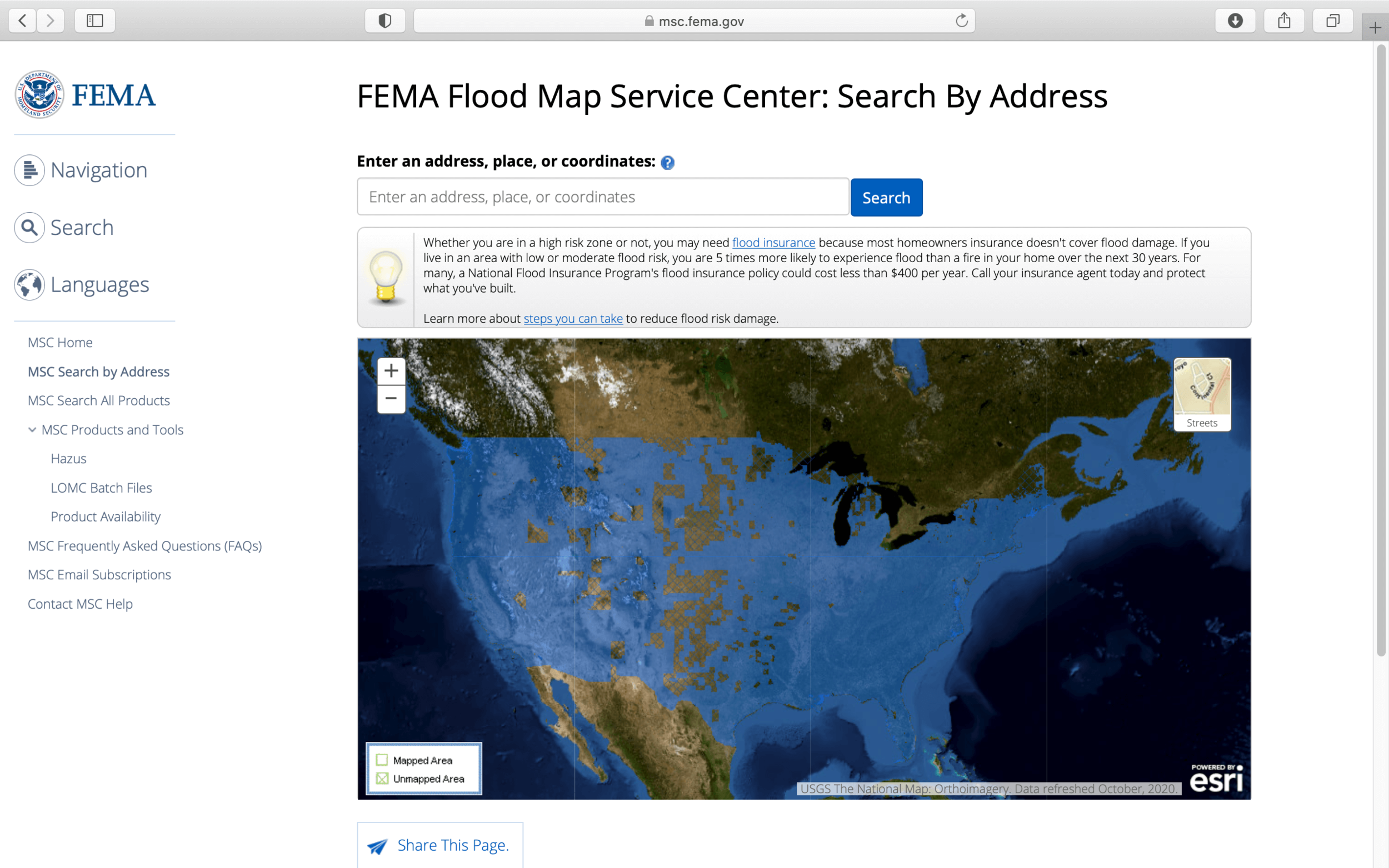

The Federal Emergency Management Agency (FEMA) has a page where you could simply key in an address and retrieve the result of its flood status.

https://msc.fema.gov/portal/search

Note that FEMA maps get updated every 5 or 10 years (weather obviously changes) so this does not mean that your property will forever have the same geographical qualities, but it’s a good sense of where things stand.

Here’re some example addresses:

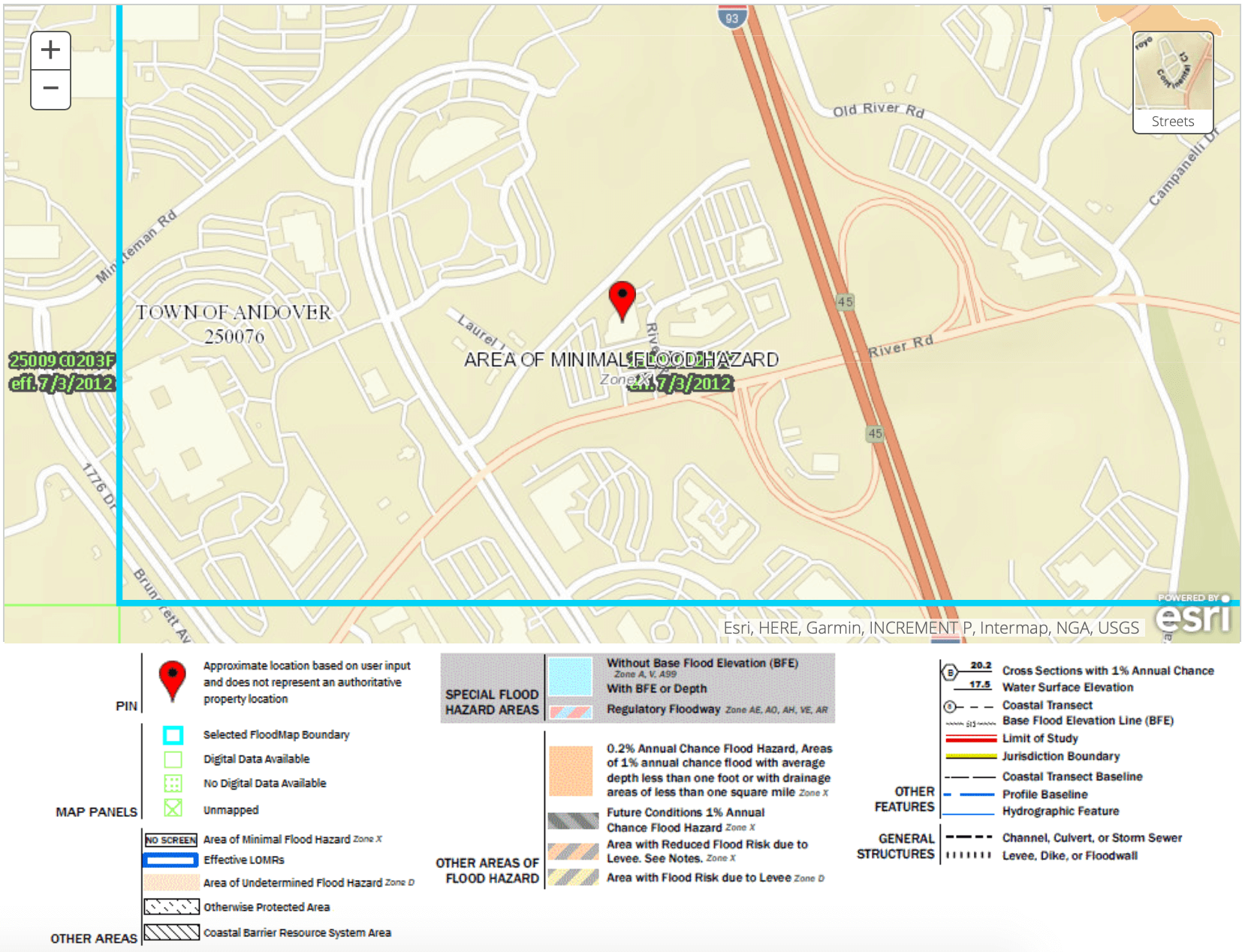

1. Keller Williams Office at 138 River Rd, Andover MA.

Yes, you’d want see “Area of Minimal Flood Hazard”, which basically means that it’s not in a recorded flood zone. Streets and nothing else.

2. Liberty Square Rd, Boxborough

Boxborough and the surrounding towns are very wet areas. Unsurprisingly, there’s a Special Flood Hazard Area running across town.

You must, at this juncture, be thinking that I did not embark on these necessary checks on behalf of my client prior to showing the property.

Can’t blame you for having such thoughts. News flash, I did do my homework. 😏

This was the result of my search:

Is this in a flood zone, or is this not?

2. Ask the Listing Agent if present owners are aware of the property being in a flood zone or pay flood insurance.

Note that Agents should rightfully disclose if a listed property is in a flood zone. It’s obviously a material consideration for all Buyers.

Zooming in:

I was unsure if the above result meant that the property was in a flood zone – the property technically is because the lot extends southwest, but the structure does not appear to be overlaid in blue?

“Do the present owners pay for flood insurance”, I asked.

“Seller said no”, replied the Listing Agent.

I relayed the same to my client.

FYI, a better question should have been “Are the present owners aware if their property is in a flood zone?”. Why? Well, if this property was purchased with cash or if there was no standing mortgage on it, it would be in the owner’s discretion whether or not to have flood insurance. There is a difference between being aware and needing to pay for flood insurance.

3. What if the Bank pulls a flood certification and the property is now in a flood zone?!

If you’re a Buyer reading this, you need to decide if you have some tolerance for living in a flood zone, or none at all. If your honest answer is “none at all”, you should just move on and allow the Seller to find a new Buyer. Be fair to everyone’s time. If it’s “it depends on how much flood insurance costs”…

You need to contact an engineering/surveying company for a FEMA Flood Elevation Certificate in order to seek flood insurance coverage.

Here’s shedding light on the context.

a) The bank would mandate flood insurance.

b) You can’t get flood insurance by calling companies and getting quotes. They won’t quote you.

This isn’t like an auto insurance policy where you could call your auto insurance provider to get an estimate. NO ONE would quote you; no one would be willing to put it in writing.

You could beg.

“Please, please just throw me a number, just an estimate, a ballpark number, pleeeeeeease!”

They would ask,

“What zone does your property fall in?”

“Zone A”

“Maybe $800 to $6,000… it could be even more.”

“How much more?”

“It depends.”

Not. Kidding.

c) Insurance providers need a site elevation plan in order to provide an accurate quote.

The site elevation plan is therefore your key to figuring things out.

Get a site surveyor. Where to start? Not your home inspector as I’ve tried that.

I reached out to an established engineering company in the city and heard that it may take 4 weeks. 4 WEEKS!

Shout out to Francis Bevilacqua III from BeviBuilds for his contact from Realworks!! Thank you Fran!!!! 🙏

Brian J. Buia, P.E.

Realworks, LLC

19 Central Street, Byfield, MA 01922

Phone: +1 (978) 270-7966

Email: bbuia@realworksgroup.com

Website

I reached out to Brian who answered the phone and put together a concise email and proposal immediately. Thank you Brian!!!! 🙏

Salient point from email about site elevation work entails:

“As mentioned, most of our field work would be on the exterior of the house, however, we would need approximately 5 to 10 minutes of time to access any interior basement and/or crawlspace to determine its floor elevation(s) and the bottom elevation(s) of the mechanical equipment (furnace/hot water heater/etc.).”

Cost of certificate: $600

Should you find yourself to be in the midst of a real estate transaction, these are the questions that need to be considered:

How soon can the site elevation work be scheduled?

How soon can the FEMA Flood Elevation Certificate be produced?

How long do you think you’d need to get insurance quotes? Don’t kill yourself and think an hour, or a day. Again, this isn’t like getting an auto insurance. Buffer 2 days. Trust me, it’s tried and tested.

Consider points 1-3, convey it with the Selling parties – Agent, Attorney, Seller – so that they would allow reasonable extensions for this process. If you’re reading this as part of the Selling party, please, have a little sympathy for others to get comfortable with their purchase.

If you’re the Buyer, you should have a mental budget for the amount that you’d willing to set aside for flood insurance in exchange for the property you fell in love with.

Be reasonable. Ask yourself if you’d have gone ahead to view the property had you known that the current owners pay $X for flood insurance.

FAQ

I’m also going to take some time to address some burning questions that would most definitely have crossed your mind when you first found out that the property is deemed to be in a flood zone.

1. Why were the previous owners not paying flood insurance while I now need flood insurance? Were they lying?!

The Sellers in my transaction were not. They were decent people whose flood certification 7 years go determined the property to be outside the flood zone and therefore had no need for flood insurance.

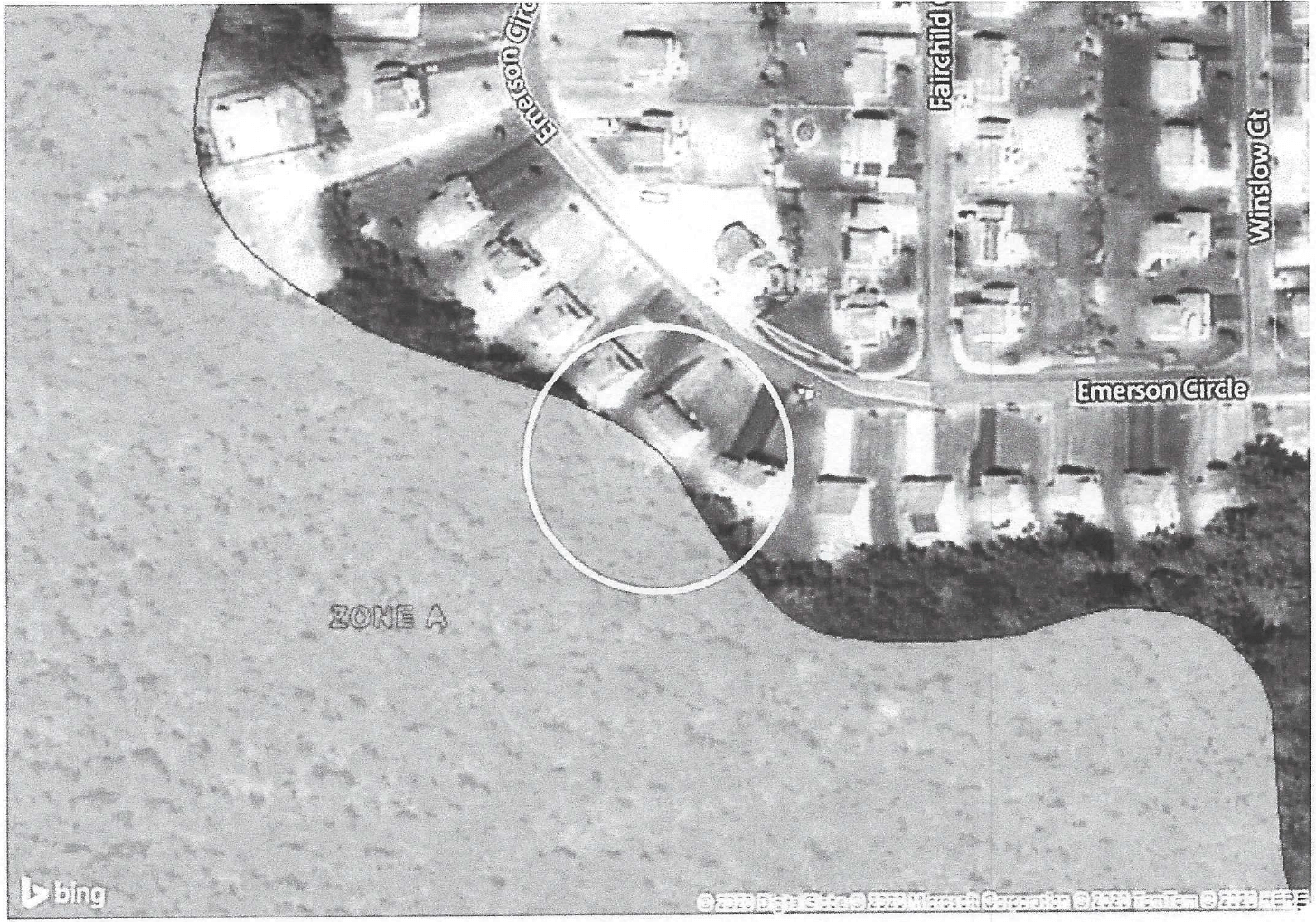

2. Can I contest the flood certification before embarking on site elevation?

You can try. My Buyer did, and the process was remarkably unscientific. All the company did was copy and paste a zoomed in (grainy) version of the same FEMA flood map to show that part of the structure is touching the flood zone. Never mind that this is a bird’s eye view and that structure sticking out of the property is an overhanging deck and that the house sits on a SLOPE! Apparently, a tangent is all you need to be IN A FLOOD ZONE.

A map from Bing is just great. I would have felt better if it was NASA.

This process caused us about 4 days. It was a boatload waste of time, and seeing the result of that determination was supremely aggravating.

3. Is this an issue of my lender – should I switch lenders?

Not sure. I’ve not heard of anyone who’s experienced this sudden determination of flood classification, let alone a lender-switch with a successful outcome. I suppose if all flood certification companies read the flood maps as they would FEMA’s guidelines (where are the guidelines anyway?), it wouldn’t make a difference.

4. What if the previous owners needed flood insurance- can I request for their Flood Elevation Certificate for quotes?

No. Elevation plans must be no older than 2 years in order to be submitted for quotes.

5. This property is on a slope. There must be a mistake. Can I contact FEMA to have the property’s flood zone classified?

Yes. After you’ve purchased the property and gained ownership. Deal with the immediate process to close first; submit your supporting documents to FEMA later. Read Section 5 on “Can I contest FEMA to have my property removed from the flood zone?”.

4. Which companies provide the best flood insurance quote?

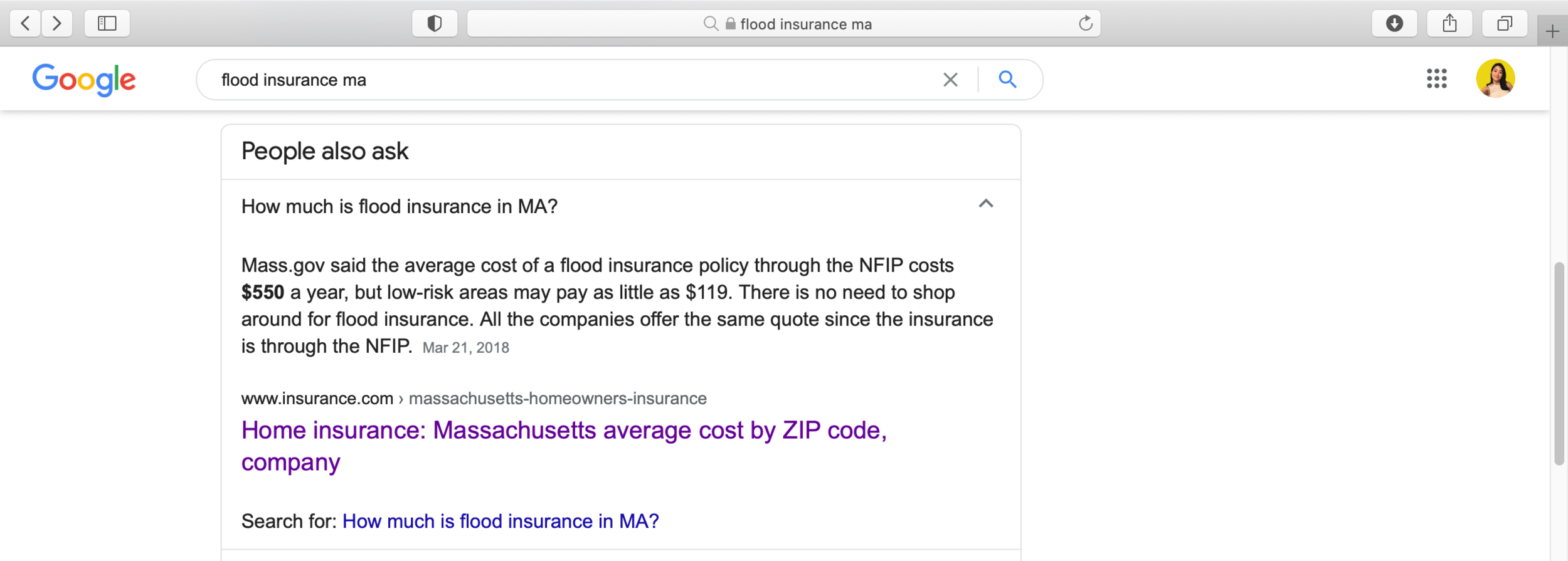

A quick Google search showed the following:

“There is no need to shop around for flood insurance. All the companies offer the same quote since the insurance is through the National Flood Insurance Program (NFIP)” – is WRONG.

That’s what the companies that sell NFIP insurance tell you.

We did reach out to a number of known insurance providers who sold NFIP insurance and got quotes in the range of $4,412 - $6,600. It’s a range, because there was a choice of going with higher or lower building deductible.

Francis (again, bless his heart) shared his flood insurance contact from Appletree Insurance:

Scott A. Simoes, Principal/CEO

Appletree Insurance

33 Indian Rock Rd Bld. 5, Ste. 3

Windham, NH 03087

Phone: 603.881.9900

Email: scott@appletreeins.com

Website

Scott came back with $929.84.

Why the huge difference? Because Scott’s company is a private insurance broker and private insurance has a different risk assessment as compared to the NFIP’s.

And before you think that private insurance is sketchy, note that the insurance product quoted was one offered by Lloyd’s of London.

Lloyd’s of London has existed since 1686.

Flood’s mundane when you consider that the company has insured David Beckham’s legs and a list of crazy things.

My client ultimately went with a cheaper quote offered by Insurox. The insurance itself also by Lloyd’s of London.

5. Can I contest FEMA to have my property removed from the flood zone?

You can. Francis, for example, shared that he knowingly built his property on a flood zone but raised the fill of the land such that it’s above base flood elevation. He’s had to go through the same process of getting flood insurance, but later submitted necessary documents to FEMA to have his property removed from the flood zone.

Here’s where to start:

https://www.fema.gov/flood-maps/change-your-flood-zone#lomc

Read Part 2 of this drama in this blog post on How to remove a flood determination! PS, it was a success!